Car Insurance for High-Mileage Drivers

High-mileage drivers and auto insurance

How many miles you drive annually is one of the rating factors insurers use to determine your insurance premium. Drivers who clock more miles than the average — about 12,000 miles per year — pay more for car insurance because of the heightened risk of being on the road more often than a low-mileage driver. The odds of a high-mileage driver getting into an accident are higher. While low-mileage discounts exist in the form of telematics programs and usage-based insurance companies, rewarding these drivers for their lessened risk, the same can’t be said about high-mileage drivers.

We’ll help you navigate car insurance as a high-mileage driver by providing a snapshot of what you can expect to pay, so you can easily find a reasonably priced policy. Keep in mind the driver profile from our methodology may differ from your own — so use our data as a starting point in your search.

What is considered high-mileage in auto insurance?

Since 12,000 miles per year is considered the average, this is usually the default mileage an insurance client is typically rated for when receiving an insurance quote. You could be considered a high-mileage driver if you drive more than that amount. If you drive 7,500 miles or less per year, you may be placed in the low-mileage tier by insurance companies.

See below how your premium can change depending on your annual mileage.

| Annual Mileage | Avg. Annual Premium |

|---|---|

| 0-7500 | $1,710 |

| 7501-10000 | $1,760 |

| 10001-15000 | $1,795 |

| 15001+ | $1,826 |

The good news is that once you’re already placed in the high mileage tier, your rate is only marginally affected by how many miles you drive; there’s only a difference of a little over 1% in the premium a 15,000 mile-per-year driver would pay versus a driver who covers double that distance. However, high-mileage drivers pay about 38% more for auto insurance than do low-mileage drivers overall.

The only factor that could majorly increase your rate as a high mileage driver is your location. California is the only state in which exact mileage is a more substantial rating factor than other states. While almost all states saw only a 1% to 3% difference in premium between drivers traveling 10,000 miles versus 30,000 miles per year, California saw a 30% price gap between them.

Paying too much for car insurance?

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

What are my insurance options as a high-mileage driver?

We surveyed seven car insurance companies to see which one offers the cheapest car insurance rates for high mileage drivers — in this case, those driving at least 15,000 miles per year.

| Company | Avg. 6 Mo. Premium | Avg. Monthly Premium |

|---|---|---|

| Allstate | $1,344 | $224 |

| Farmers | $1,026 | $171 |

| GEICO | $1,038 | $173 |

| Nationwide | $888 | $148 |

| Progressive | $859 | $143 |

| State Farm | $769 | $128 |

| USAA | $659 | $110 |

There’s substantial variance in rates from insurer to insurer, with an average six-month premium of $940 — or about $157 per month. It’s important to compare as many companies as possible when looking for a new auto insurance policy, and this holds especially true for high-mileage drivers. Consider the fact that you’re on the road more frequently, and thus more likely to file an insurance claim — so you should choose an affordable insurer you can trust. If you don’t qualify for car insurance through USAA, consider starting your search with State Farm and Progressive — the cheapest insurance companies for high mileage drivers.

Usage-based insurance — like Metromile and Root — is more advantageous for low-mileage drivers than for long-haul insurance customers. These companies price car insurance premiums based on driving habits — such as mileage — with a “pay as you go” model, using telematics devices to track behavior. You could be better off with a traditional insurance company if you tend to have a long commute.

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

How much insurance coverage does my high-mileage car need?

Our general rule of thumb is to get as much insurance as you can afford. But a high-mileage vehicle is typically an older car — one that’s spent year-after-year logging all those miles on its odometer. Because cars rapidly depreciate with age, it’s usually not worth insuring an older car with full coverage.

If the car is fully paid off and worth less than $4,000, you likely won’t need collision and comprehensive coverage — it would be sufficient to carry liability coverage. Because collision and comprehensive are meant to physically protect your own vehicle based on its value, if its value doesn’t meet a certain threshold, it’s probably not worth adding physical coverage.

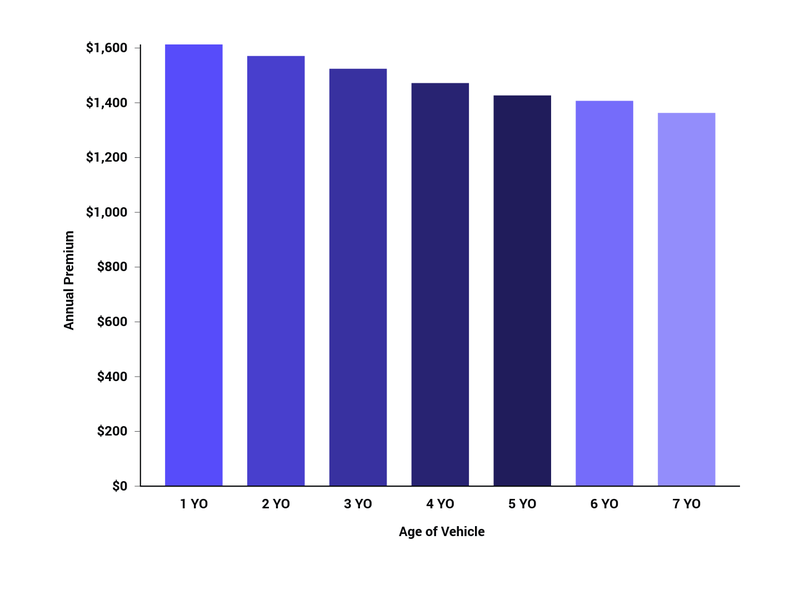

Cars with higher mileage are typically cheaper to insure. We found that premiums drop about 2.5% on average for every year your car ages. If you’re looking to save money on car ownership and the cost of insurance, forgo the shiny new car and consider a used car.

Learn more about how much it costs to insure a new versus old car.

Finding insurance as a high-mileage driver

While car insurance may be more expensive for you, you should have no problem finding reasonable rates as long as your other rating factors — like your age, credit score, driving record, and location — are not too frowned upon by potential insurers. Rates vary more from insurer to insurer than they do by your annual mileage if you’re already considered a high mileage driver — unless you live in California.

While there are no mileage-specific insurance discounts for high mileage drivers, there are other ways to save on car insurance. Enter your zip code below to see car insurance quotes from over 100 companies — you might be surprised by how much you can save.

Get an auto insurance quote in minutes.

Related Content

- High-Risk Car Insurance

- Car Insurance for Foreign Drivers in the U.S.

- Car Insurance with No Credit History

- Male vs. Female Car Insurance Rates

- How Do Medical Conditions Affect Car Insurance Rates?

- What is an Auto Insurance Score?

- Car Insurance with No Insurance History

- Low-Income Car Insurance

- How Does a GED Affect Car Insurance Rates?

- Car Insurance for Drivers with Disabilities

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.